Boost trust and commercial growth with the Trust Explorer Tool

Where should brands focus attention in a world full of economic challenges and rapid technological change? The priorities seem numerous, from AI to fragmenting audiences, but building trust should override all else.

The importance of building trust has been on the radar for some time, but for many brands, it should now be the prized attribute for commercial success. Customer loyalty is depleting, competition for share of wallet is fiercer than ever and a destabilising world of data hacks, deep fakes and misinformation is undermining trust.

Marketers need to build brand trust to deliver growth as trust is the glue that binds together brand resilience, long-term relationships and customer lifetime value. Despite this, 70% of consumers say they don’t know what information to believe1 and only 8% say they have great confidence in large businesses.

This means marketers and agencies need a deeper understanding of the nature of trust, how it is built and how to integrate it into campaign planning. To help develop greater insight and provide guidance, we invested in extensive research to inform our groundbreaking The Trust Factor report and developed an easy-to-use tool.

The Trust Factor Report

Trust’s relationship with commercial success

Trust is often perceived as a binary attribute that brands either have, or don’t have. The truth is more nuanced; there are levels of trust, various approaches to building it and a myriad of ways it can be eroded. It also has a significant impact on commercial success. Trust plays a vital role in encouraging consumers to consider your product or service, as revealed in our research showing that 74% of consumers said they would spend more if they trusted a brand.

In many sectors trust is the essential currency. Where would the insurance industry be without trust? Or retail transactions? Or utilities suppliers? We pay our bills and trust our supplier to keep the lights on or our Wi-Fi working. And if these fail, the amount of trust they’ve ‘banked’ through good service, experience and regular communications depends on whether we are forgiving or switch to another competitor.

The research we carried out for our report identifies eight interconnected pillars on which trust is built.

These are:

- Reliability

- Reciprocity

- Aligned Interests

- Stakes for both parties

- Familiarity

- Fame

- Frequency of Communication

- Tenure

Any organisation that maintains and invests in these pillars as part of its relationship with customers and prospects will build trust. Conversely, if the power of any pillar diminishes, this will have an impact on trust levels and could result in commercial loss.

The role of mail and media in the trust equation

Our separate Conjoint Analysis on the combination of variables that can build trust found that the messenger or brand accounts for 50% of trust, the medium 42%, and the message 8%. So, an audience’s trust in communication is mainly based on how much they trust the brand and the channel.

A deeper dive showed how different channels relate to the eight pillars of trust. For instance, mail can build brand trust. For example, direct mail and door drops drive 3% of reliability – a pillar which directly informs 35% of trust. Direct mail is ranked top as the most trusted channel (54%) thanks to factors such as mail being personal, informative, enjoyable to receive, physical and tangible.

But we know integrated campaigns where channels amplify and reinforce each other’s strengths are the most effective. The same thinking applies when it comes to creating trust. Specific channels relate to the pillars of trust in diverse ways. For instance, the optimum combination of channels to increase familiarity will be different to the mix for fame. It sounds like an intricate matrix to juggle but our new tool can help organisations and agencies better plan for building trust effectively.

The Trust Explorer Tool

This data-driven, strategic tool is built on the vast amount of information collated for our research to cut through the complexity of trust. Especially, for brands and organisations where trust is a non-negotiable asset. For example, brands operating in insurance, banking, utilities, charity, retail, telecoms and government sectors.

Marketers can establish a baseline level of trust in their organisation given their sector and size, and then determine their chosen marketing objective from a menu including:

- Drive customer acquisition

- Improve brand awareness

- Boost customer retention

- Build brand awareness

- Grow market share

- Build brand engagement

The tool will then make a recommendation as to which of the eight trust pillars will best serve the chosen objective, before giving a clear ranking of which communications channel or channels will meet that goal.

The Trust Explorer Tool even provides an indication of how much an organisation’s trust score could rise if the guidance is followed.

Example: Retail

Let’s follow a Retail brand through the process, it could be an athleisurewear chain, for instance.

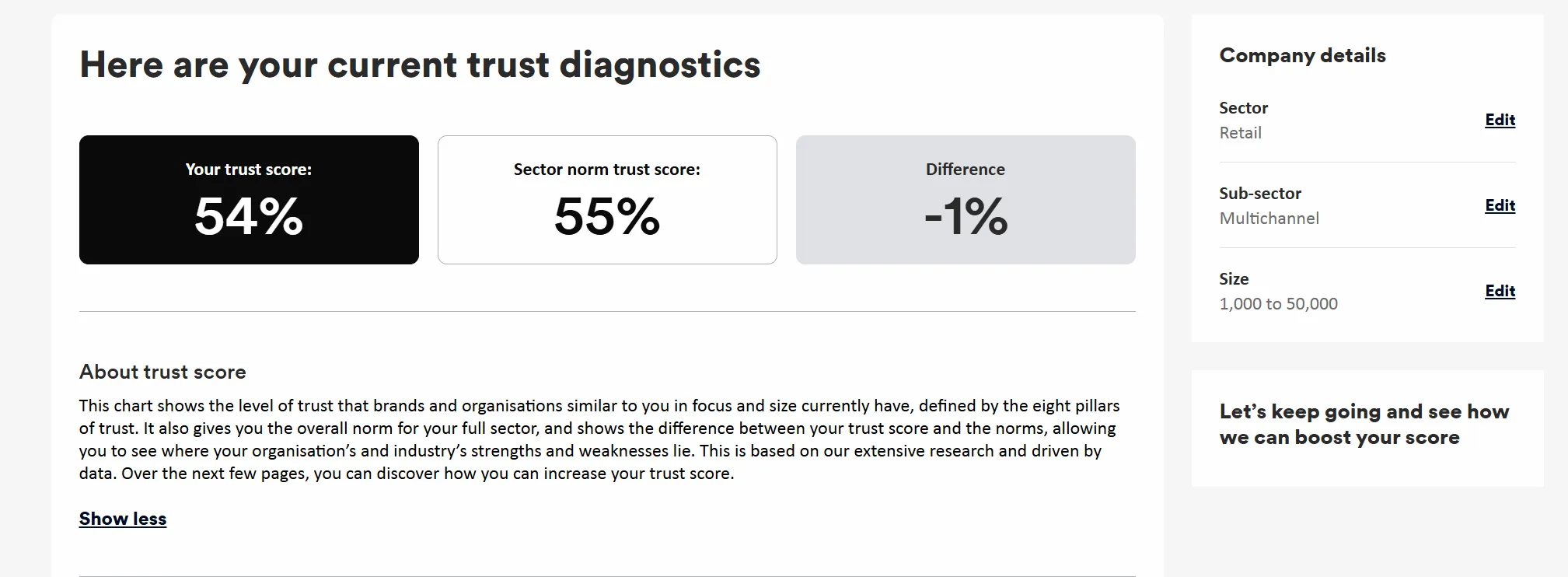

Our brand chooses a multichannel campaign and indicates its size for the tool by number of employees. Immediately it receives a trust score as compared to the sector norm.

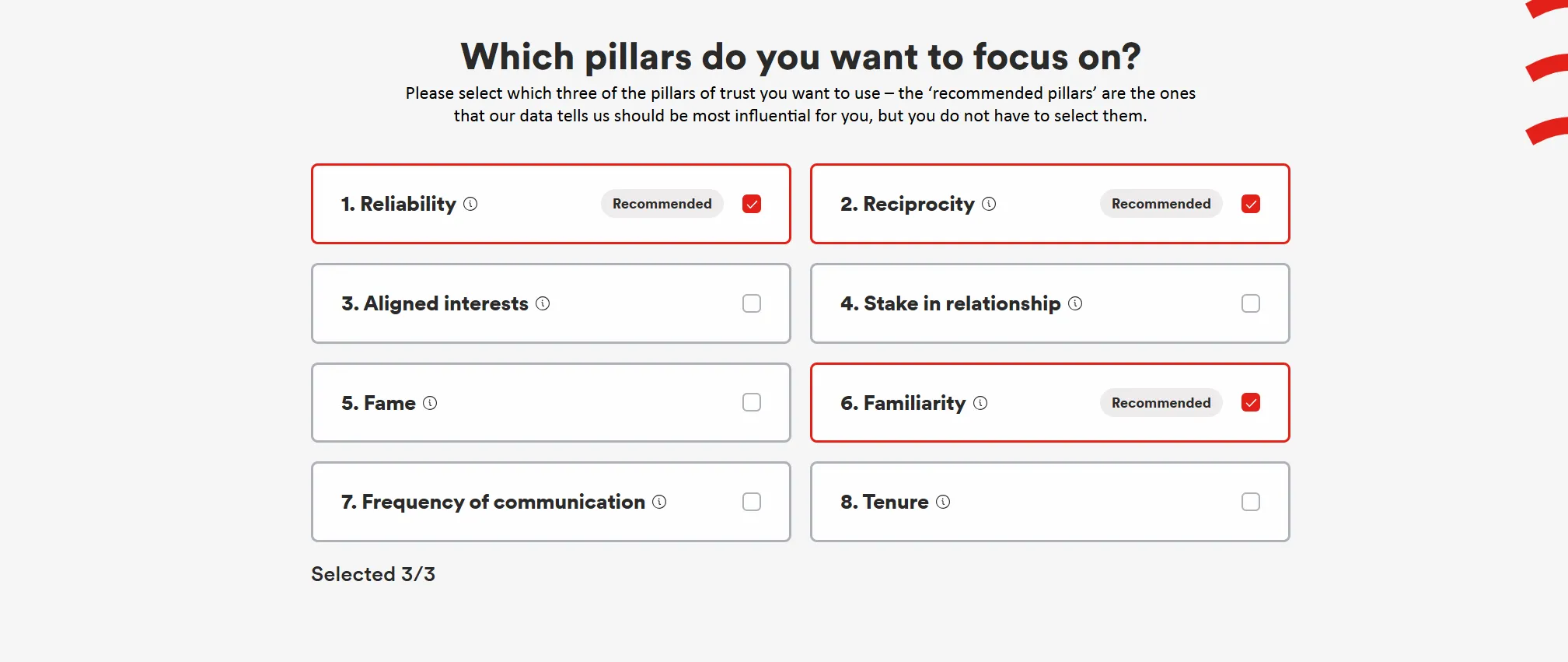

The tool then asks for primary marketing objectives and makes suggestions on how to improve the trust score. Our athleisurewear brand has several high street competitors and the overall market is flat, so it chooses Grow Market Share as an objective, and the tool suggests investing in channels to grow the trust pillars of Reliability, Reciprocity and Familiarity.

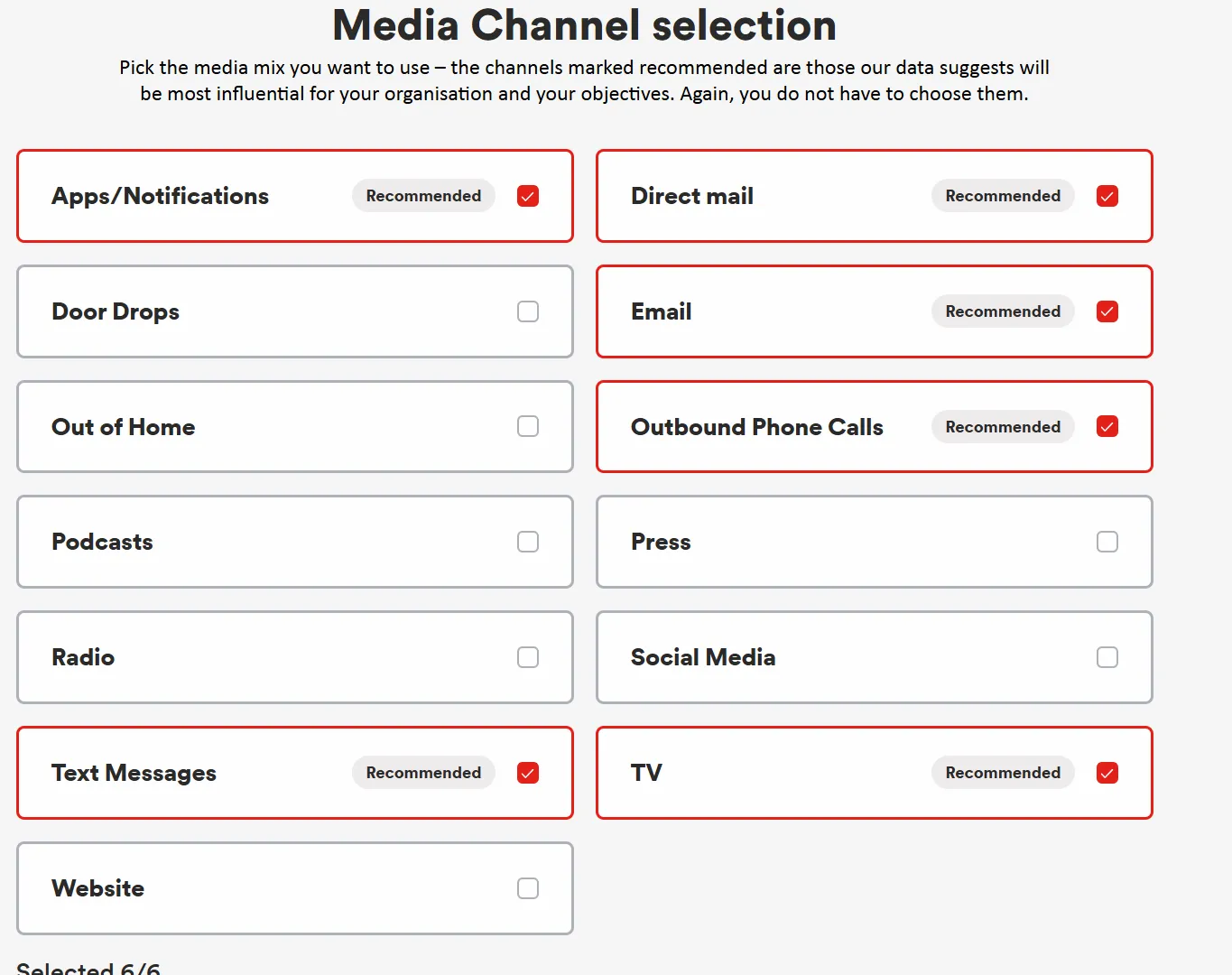

Then the tool recommends six channels that will best help with a campaign to meet the objective.

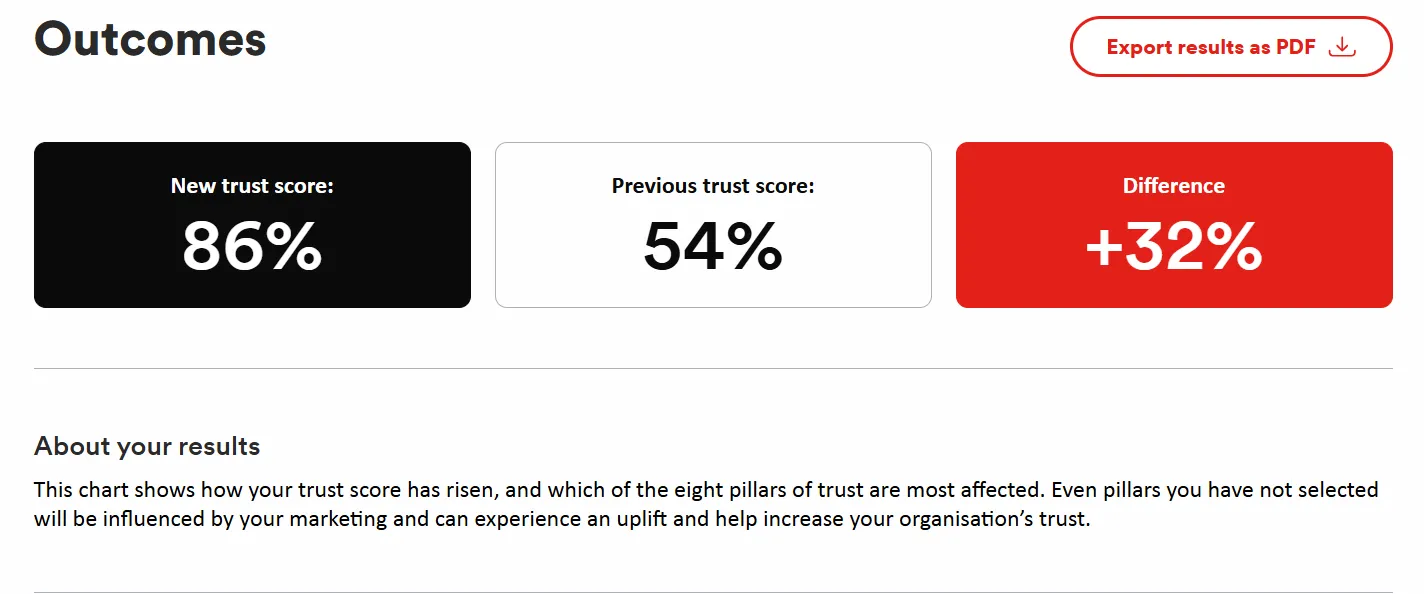

Finally, the Explorer forecasts outcomes. In this case the media investment could boost the trust score by +32% to 86%. It also shows how the three relevant trust pillars are affected.

Example: Finance

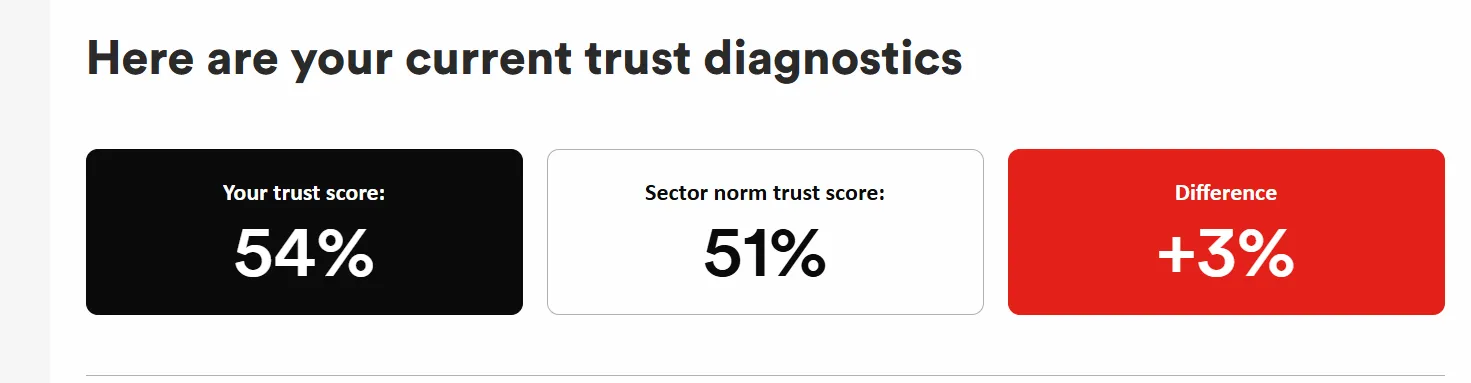

Let’s take another example, in this instance a General Insurance Provider, a sub-sector option of Finance. For a company under 7,500 people, we find these current trust scores.

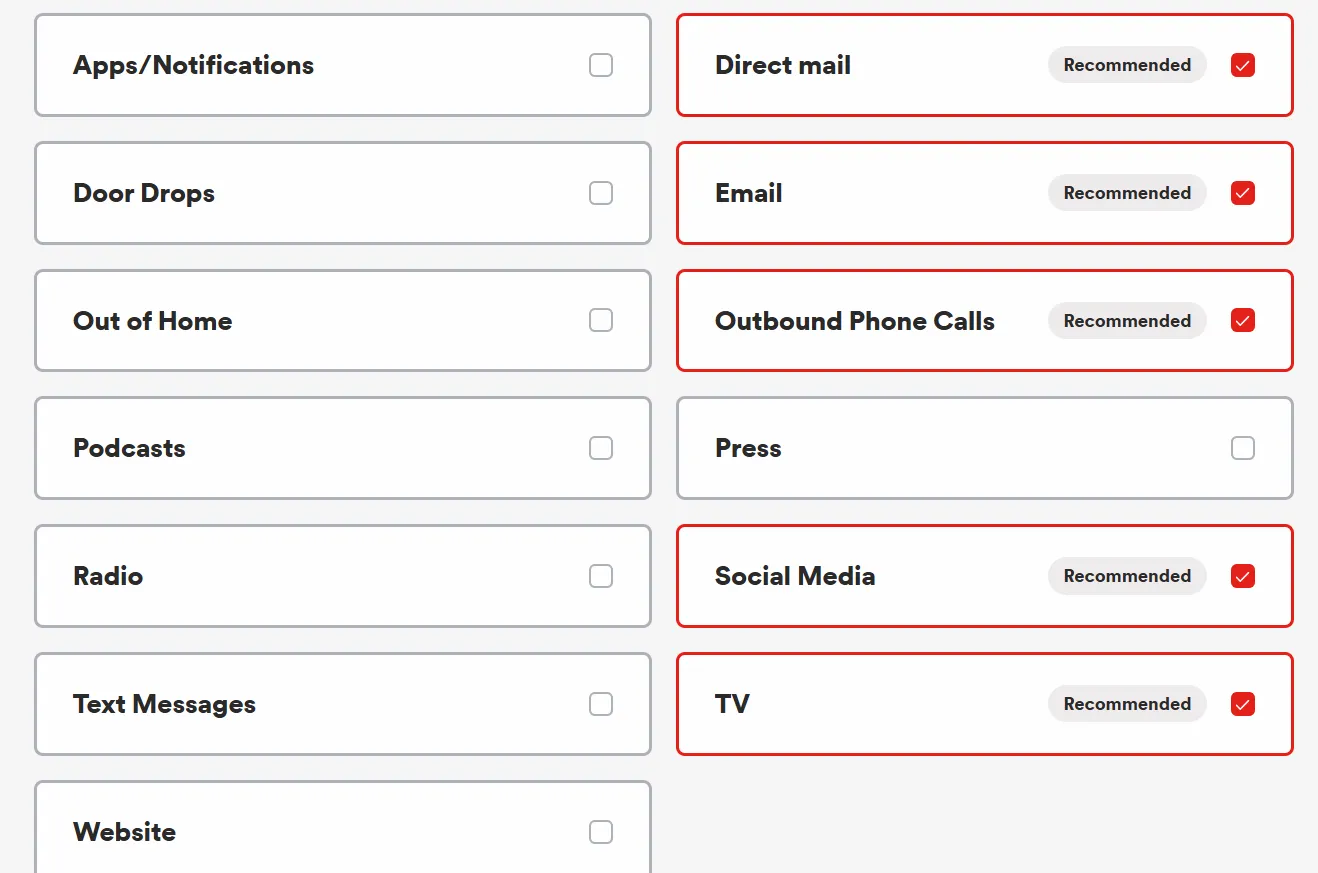

Our insurer is launching a new travel product and wants to improve brand awareness. The tool recommends a focus on the pillars of Reliability, Reciprocity and Tenure. It also suggests what media channels to use for an optimal media mix.

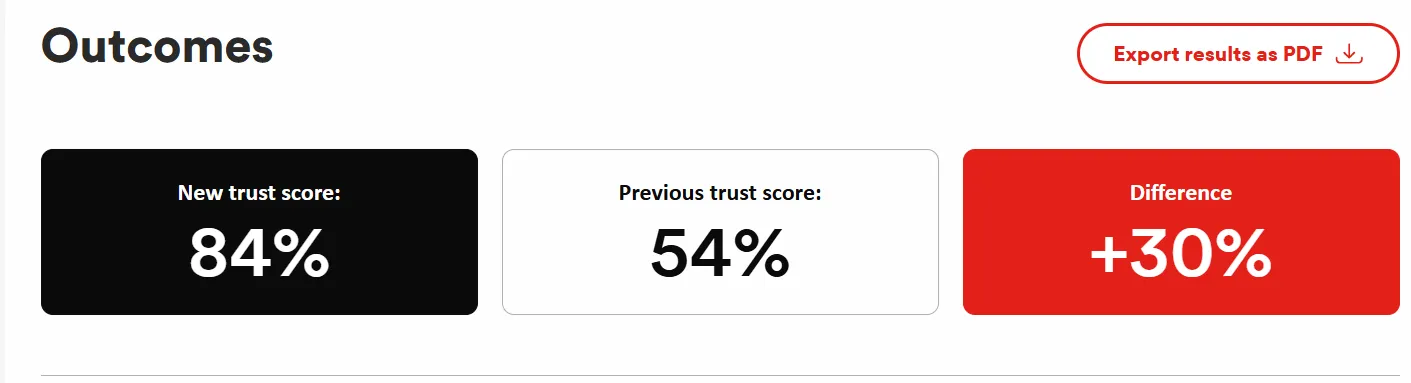

And if we follow through on the recommendations, here is the trust improvement forecast for the Insurance Provider, and our insurer will also see by how much individual trust pillars will increase.

While not intended to provide detailed marketing or media planning advice, the Explorer is a foundational tool to help brands understand how to use communications through different channels to build or rebuild trust.

Conclusion

Brands that recognise the value of trust and take steps to safeguard or boost their credibility in the eyes of their customers will build a sustainable competitive advantage. In a volatile business landscape, it’s an investment that will pay back.

Find out more about how trust can help prepare your organisation for commercial success by downloading The Trust Factor report.